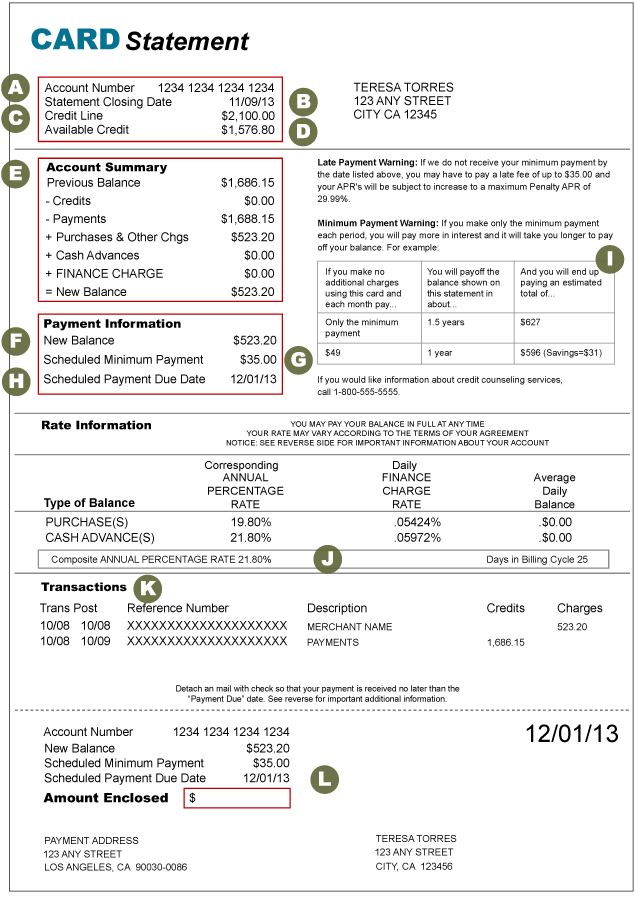

Some people feel overwhelmed by the information provided in their credit card statement. However, understanding this information is CRITICAL to understanding how credit cards work and how they can quickly put you in a growing and possibly, severe debt if neglected.

A. Account Number – the same number that is physically on your credit card.

B. Statement Closing Date – the ending date for all transactions posted on this statement.

C. Credit Line – the TOTAL amount of money available to you as credit for that account

D. Available Credit – {Credit Line – New Balance} the remaining amount of money available to you as credit.

E. Account Summary – All of the activity that has happened in this current billing period.

- Previous Balance – the balance from the LAST statement

- Credits – any returns or refunds issued in this billing period

- Payments – amount paid on the previous bill

- Purchases and other Charges – the TOTAL amount of current charges from THIS bill

- Cash Advances – amount of money charged to the card used as CASH (this amount carries a higher interest rate)

- Finance Charge – the amount of money charged to you for any outstanding balance from any previous statements.

F. New Balance – the current amount owed from this statement

G. Scheduled Minimum Payment – the minimum amount of money that you should pay.

H. Scheduled Payment Due Date – the date that payment must reach the credit card company.

I. Warnings Regarding Payment:

- Late Payment Warning: If payment is not received by the Due Date, you will pay a specified late fee and your APR (Annual Percentage Rate) may be increased as a Penalty.

- Minimum Payment Warning: A clear example of how just paying the minimum amount each month exponentially grows the amount you owe because of the interest charged.

J. Rate Information – This area explains the interest rates for your card. There is one rate for purchases and one for cash advances.

K. Transactions – A detailed list of ALL transactions that took place in the billed time period. It provides the date the transaction took place and the date it posted (or went through), the description of the store or entity, and the amount for each transaction.

L. The Payment Slip: This portion gets sent in to the credit card company, along with your payment (in the form of a check or money order – NEVER SEND CASH). Write in the amount that you are paying, detach and mail in to the address listed with the payment. **Also, if you are mailing the payment, make sure that it is sent with ample time to arrive BEFORE the date due.

**Make sure to write in your account number in the Memo section of the check so that it gets processed correctly.

*Photo Source: handsonbanking.org